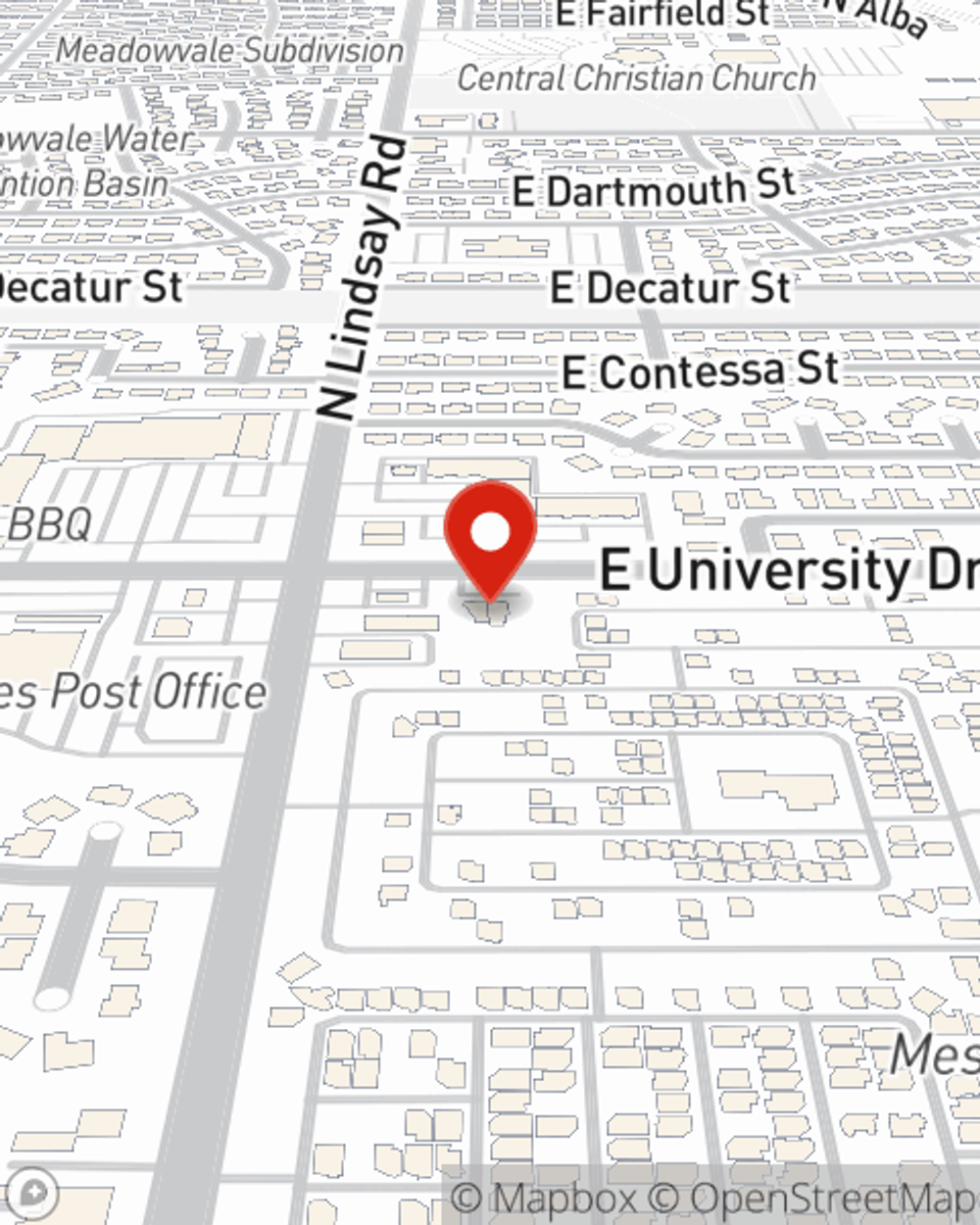

Life Insurance in and around Mesa

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Mesa

- Gilbert

- Apache Junction

- Chandler

- Queen Creek

- Scottsdale

- San Tan Valley

- Tempe

- Coolidge

- Casa Grande

- Maricopa

- Good Year

- Buckeye

- Phoenix

- Florence

- Prescott

- Cottonwood

- Arcadia

- Cave Creek

- East Mark - Arizona

- Flagstaff

- Marana

- Litchfield Park

- Kingman

It's Never Too Soon For Life Insurance

There's a common misconception that young people don't need Life insurance, but even if you are young and a recent college graduate, now could be the right time to start talking about Life insurance.

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Life Insurance Options To Fit Your Needs

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with level or flexible payments with coverage to last a lifetime coverage for a specific number of years or another coverage option, State Farm agent Misty Virgil can help you with a policy that works for you.

If you're a person, life insurance is for you. Agent Misty Virgil would love to help you find out the variety of coverage options that State Farm offers and help you get a policy that works for you and your partner. Call or email Misty Virgil's office to get started.

Have More Questions About Life Insurance?

Call Misty at (480) 275-5838 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Misty Virgil

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.